Over the last 7 days, the South Korean market has dropped 2.1%, with the Information Technology sector declining by 3.5%. Despite this short-term volatility and flat performance over the past year, earnings are expected to grow by 28% per annum over the next few years, making dividend stocks an attractive option for investors seeking steady income and potential growth.

Top 10 Dividend Stocks In South Korea

|

Name |

Dividend Yield |

Dividend Rating |

|

Kia (KOSE:A000270) |

5.82% |

★★★★★★ |

|

LOTTE Fine Chemical (KOSE:A004000) |

4.71% |

★★★★★☆ |

|

NH Investment & Securities (KOSE:A005940) |

6.29% |

★★★★★☆ |

|

Hyundai Steel (KOSE:A004020) |

4.03% |

★★★★★☆ |

|

Shinhan Financial Group (KOSE:A055550) |

3.98% |

★★★★★☆ |

|

KT (KOSE:A030200) |

5.40% |

★★★★★☆ |

|

Samyang (KOSE:A145990) |

4.06% |

★★★★★☆ |

|

KB Financial Group (KOSE:A105560) |

3.98% |

★★★★★☆ |

|

Kyung Nong (KOSE:A002100) |

7.28% |

★★★★★☆ |

|

HANYANG ENGLtd (KOSDAQ:A045100) |

3.58% |

★★★★★☆ |

Click here to see the full list of 75 stocks from our Top KRX Dividend Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyang Holdings Corporation, with a market cap of ₩504.94 billion, operates in chemical, food, packaging, pharmaceutical, and other industries across South Korea and internationally through its subsidiaries.

Operations: Samyang Holdings Corporation generates revenue through its diverse operations in the chemical, food, packaging, and pharmaceutical sectors across South Korea and various international markets including China, Japan, other Asian countries, and Europe.

Dividend Yield: 5.3%

Samyang Holdings has exhibited strong earnings growth, with net income rising from ₩18.55 billion to ₩27.89 billion in the first quarter of 2024. The company trades at a 29% discount to its estimated fair value and offers a top-tier dividend yield of 5.32%. Despite only paying dividends for five years, its low payout ratios (earnings: 15.5%, cash flow: 24.4%) suggest sustainable and well-covered dividends, though the track record is relatively short.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyung Trading Co., Ltd. primarily supplies organic and inorganic chemical products worldwide and has a market cap of ₩220.88 billion.

Operations: Samyung Trading Co., Ltd. generates revenue from various segments including Shoemaker (₩212.54 million), Spectacle Lens (₩15.57 million), and Automotive Parts (₩253.22 million).

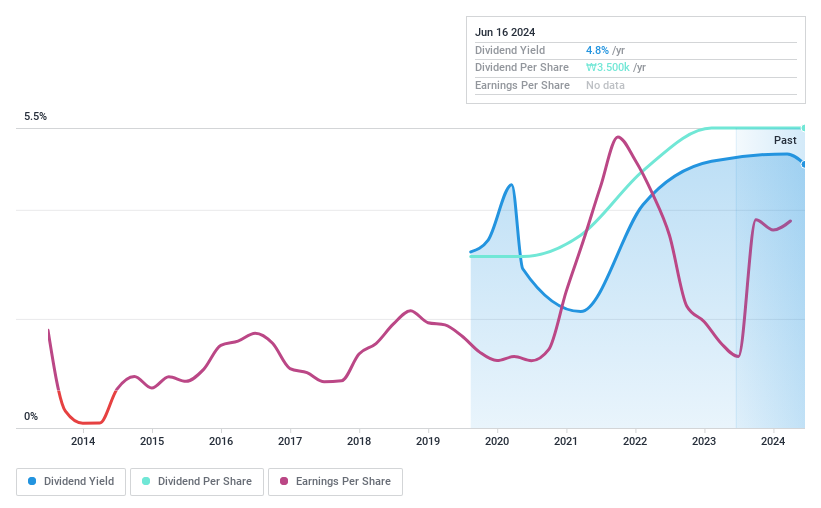

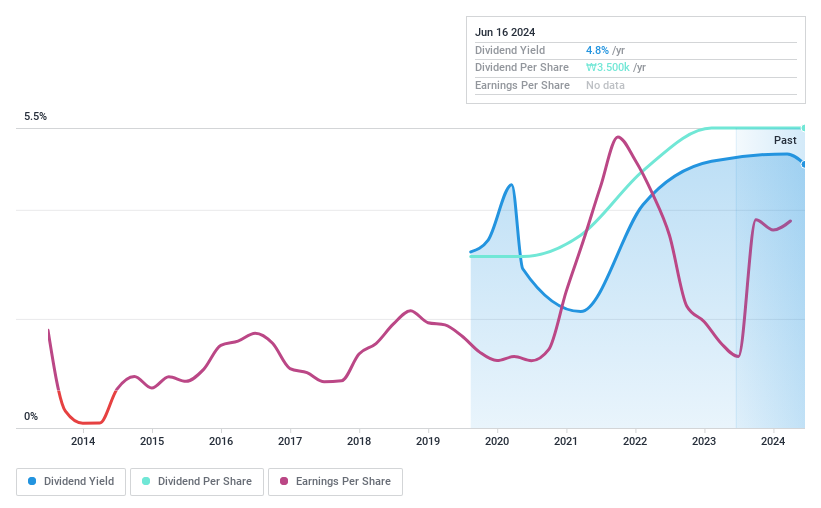

Dividend Yield: 4.8%

Samyung Trading’s dividend payments are well covered by earnings (payout ratio: 19.6%) and cash flows (cash payout ratio: 48.4%), with a stable history despite being less than 10 years old. The company’s dividend yield of 4.79% places it in the top quartile of South Korean dividend payers. Recent earnings show strong growth, with net income rising to ₩15.55 billion for Q1 2024 from ₩11.61 billion a year ago, supporting its dividend sustainability further.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Motonic Corporation manufactures and sells automotive components worldwide, with a market cap of ₩185.57 billion.

Operations: Motonic Corporation’s revenue segments include ₩354.20 billion from automotive components.

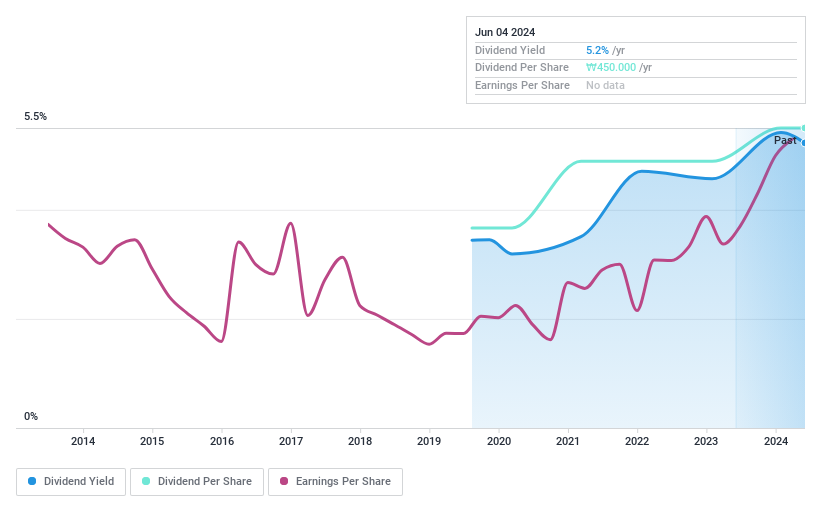

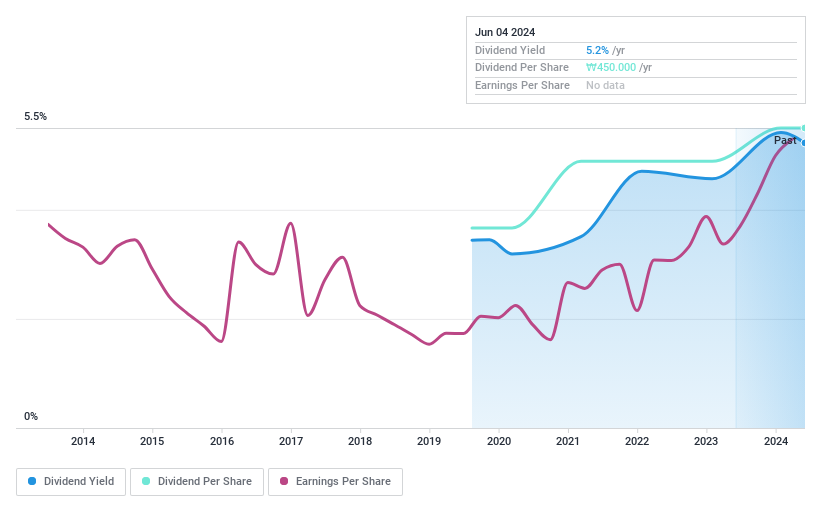

Dividend Yield: 5.2%

Motonic’s dividend payments are well covered by earnings (payout ratio: 33.4%) and cash flows (cash payout ratio: 85.9%). The company has a competitive dividend yield of 5.24%, placing it in the top quartile of South Korean dividend payers, although it has only paid dividends for five years. Earnings growth of 56.3% over the past year supports its ability to maintain and potentially increase dividends despite a shorter track record.

Next Steps

Ready For A Different Approach?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A000070 KOSE:A002810 and KOSE:A009680.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com