Investment opportunities such as Amazon (NASDAQ: AMZN) don’t come around very often. When it went public in 1997, relatively few people were using the internet on a daily basis. Fewer were daring enough to use the internet to buy things. But internet adoption grew and consumer confidence in e-commerce increased and the rest was history for Amazon.

For those brave enough to invest $10,000 in Amazon stock in 1997, that stake is worth nearly $20 million today — a true once-in-a-generation investment.

But why was Amazon such a successful business? Many investors say it was because it was a first mover in the e-commerce space. But Amazon founder Jeff Bezos disagrees.

Bezos says, “Our success at Amazon is a function of how many experiments we do per year, per month, per week, per day.” And it seems like this philosophy of success by experimentation is being adopted by another founder at a well-known $80 billion business — but more on this surprising news in a moment.

Bezos sees success and failure as two sides of the same experimentation coin. If you’re going to flip it, sometimes it painfully lands on failure — remember Amazon’s Fire Phone? But sometimes the coin flip lands on success and brings about something like Amazon Web Services (AWS).

Amazon had no idea if AWS would actually work out. As Bezos says, “If you decide that you’re going to do only the things you know are going to work, you’re going to leave a lot of opportunity on the table.” Amazon had to be willing to suffer a Fire Phone failure to bag an AWS success.

To be clear, Amazon’s AWS has been a massive success. In the first half of 2024, it accounted for almost 18% of Amazon’s net sales as well as 63% of the company’s operating profit. These numbers are tremendously consequential. If it hadn’t experimented with AWS, it’s possible that Amazon would only be worth half of what it’s worth today.

Therefore, when Airbnb (NASDAQ: ABNB) founder Brian Chesky starts talking like Amazon’s Jeff Bezos regarding experimentation, it’s time for investors to pay attention.

You’ll never believe what Airbnb plans to do now

Airbnb is an online platform that allows property owners to rent out spaces on a short-term basis. Travelers can book a room, a house, and more. And it’s a massive business already. Over the past 12 months, the company has handled nearly $80 billion in booking volume on its platform.

Incidentally, Airbnb’s market valuation is also above $80 billion.

In September, Chesky spoke at the 2024 Skift Global Forum and said, “We’re entering a new phase of the company.” Later he added, “I anticipate, every year, we launch two to three things that could eventually generate $1 billion a year annually in revenue.” In short, Airbnb is entering into the an experimentation phase of its business, following in Amazon’s philosophical footsteps.

There’s an inherent challenge for Airbnb now as an $80 billion business. As Bezos says: “As a company grows, everything needs to scale, including the size of your failed experiments. If the size of your failures isn’t growing, you’re not going to be inventing at a size that can actually move the needle.”

This is bigger than travel. At the forum, Chesky said, “We’re going to take the Airbnb model, and we’re going to bring it to a lot of different categories.” Later he added, “Eventually, we do think there’s a path here to be doing more than just travel.”

Why this is a good thing

When it comes to big ideas, Chesky didn’t offer investors many concrete details. But this is an exciting framework for Airbnb to adopt now.

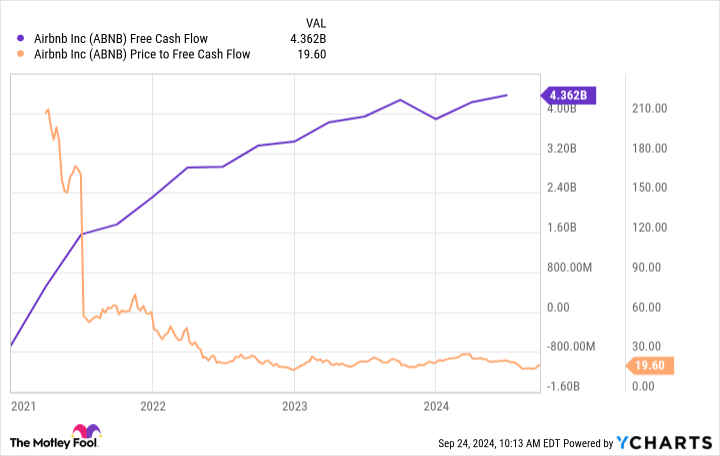

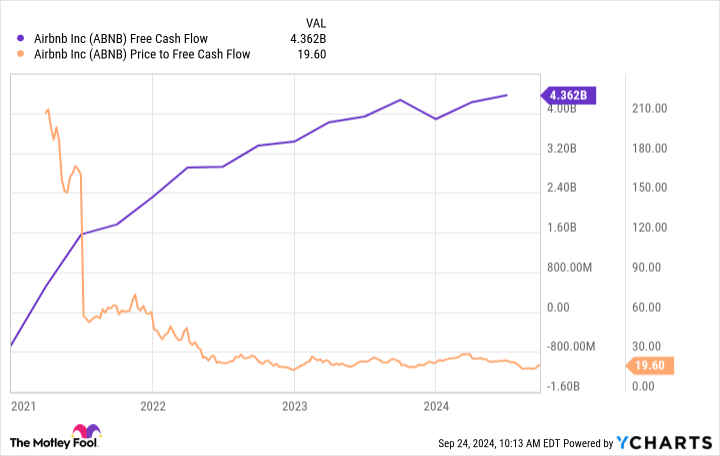

Airbnb’s core business is strong. Not only does the brand enjoy mindshare among travelers, but key metrics are also growing. And it’s an extremely profitable venture, consistently throwing off loads of free cash flow.

In short, Airbnb can afford to throw some money at some big experiments that can move the needle for the business. As Bezos warns, big experiments will necessarily lead to big failures. But if a big idea succeeds, Airbnb’s business could eventually find its equivalent to Amazon’s AWS — something unrelated to the core business that’s highly valuable.

As an Airbnb shareholder, I expect the next few years to be bumpy for Airbnb stock — investors probably won’t like its inevitable failures. But for what it’s worth, I believe Chesky is the right leader for this experimentation phase of the business. Not only did he co-found Airbnb, but he also launched a breakfast cereal business in 2008 to keep Airbnb alive when it was going broke.

It’s a little-known part of Airbnb’s history that makes me believe Airbnb will use its profits to find an amazing new avenue for long-term growth.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has positions in Airbnb. The Motley Fool has positions in and recommends Airbnb and Amazon. The Motley Fool has a disclosure policy.

Amazon Stock Was a Once-in-a-Generation Investment Opportunity Thanks to 1 Underappreciated Trait. Here’s an $80 Billion Company That Surprisingly Hopes to Follow in Its Footsteps. was originally published by The Motley Fool