Shark Beauty, the viral hair tool line launched in 2021 by cleaning appliance manufacturer Shark Ninja, is launching a new duo of scalp health-minded hair dryers.

Called the SpeedStyle Pro and the SpeedStyle Pro Flex — the difference being that the latter folds up for easy travel, and comes with an additional diffuser attachment for curly hair — the tools mark Shark Beauty’s fifth family of hair tools.

Retailing for $199 for the Pro and $229 for the Pro Flex, the offerings are similarly priced to many of their counterparts in the hot air dryer and styler categories by Drybar, BondiBoost and T3, which also sell at Sephora and Ulta Beauty.

They’re significantly more affordable, however, than those by Ghd — which unveiled a $399 two-in-one hair-dryer brush last month — and fellow household appliance maker-turned hair tool giant Dyson, whose $599 Airwrap Multi-Styler is credited by many as having spawned TikTok’s obsession with beauty dupes, following its 2021 holiday-season viral stint (which proceeded to last through most of 2022).

In launching its SpeedStyle Pro franchise, Shark Beauty aims to ramp up its mission to minimize hair damage caused during heat styling with the introduction of its Scalp Shield Technology.

“Everything we do starts with a consumer problem — that’s the real competitive advantage of Shark Beauty — and we know consumers are thinking more about the health of their scalp,” said Danielle Lessing, senior vice president of global product development at Shark Ninja. “As we looked at our portfolio we thought, ‘Let’s push it even further — let’s continue to dry hair fast and without heat damage, but layer in the added benefit of promoting healthy hair growth and minimizing scalp damage and irritation.’”

Developed in partnership with dermatologists, the protective feature is enabled with the hold of a button and purports to instantly adjust the temperature of the styler to 50 degrees Celsius for roots drying, and revert back to a user’s temperature of choice upon release — without lengthening dry time.

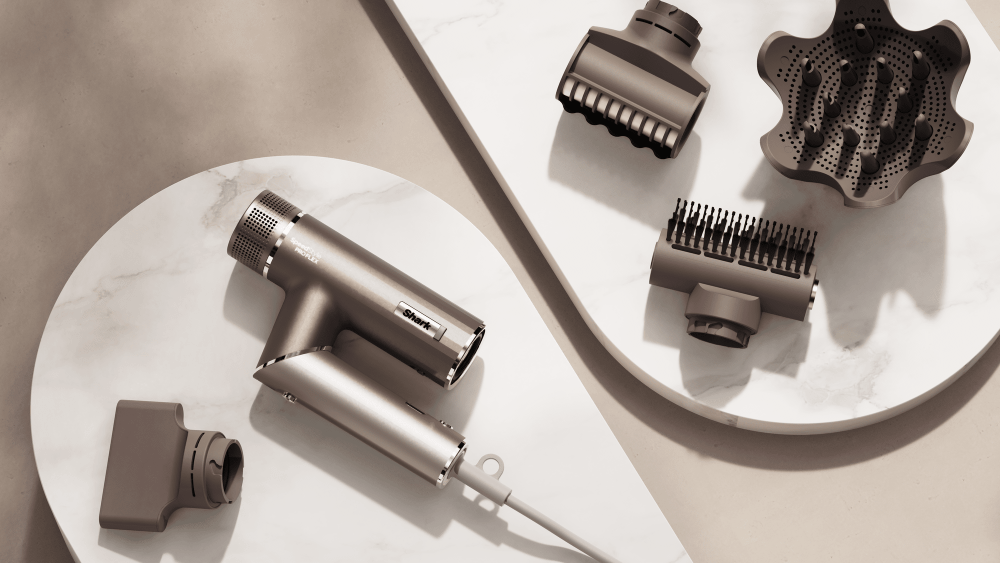

Both tools come with an assortment of Shark Beauty’s signature attachments, including the Turbo Concentrator, which boosts sleekness; the QuickSmooth Brush for creating volume, and the Frizz Fighter Finishing Tool.

The SpeedStyle Pro Flex and its attachments.

courtesy

“There’s this growing emphasis on being unapologetic about the hair that you have, so we’re always developing accessories which allow the consumer to do that and embrace and enhance their natural hair, as well as those which allow you to transform it for a more manufactured [look],” Lessing said.

Though Shark Beauty declined to comment on sales expectations for the launch, industry sources think the SpeedStyle Pro and SpeedStyle Pro Flex could reach up to $50 million in global sales during their first year on the market. The brand is available in 27 countries, and this fall will be in 500 Sephora doors and 1,300 Ulta Beauty doors.

During the first quarter of 2024, Shark Ninja did $1.1 billion in net sales, a 24.7 percent increase versus the year prior.

Cleaning appliances are the company’s biggest category, logging $414.9 million in net sales in the first quarter of 2024. Coming in second and third are the company’s cooking and beverage appliances, and its food preparation appliances.

The company’s “other” category, which includes Shark Beauty, air purifiers and and fans, comprises the smallest portion of Shark Ninja’s business, having logged $109.6 million in net sales during the first quarter. At 66.4 percent growth, however, it’s the company’s second-fastest growing category, outpaced only by the 74 percent growth of its food preparation appliances.

More broadly, data from Circana indicates the hot air styler category is up 10 percent year-over-year, reaching $276 million during the first half of 2024. The sector’s growth outpaces that of flat irons and hair straighteners, which grew 4 percent to $156 million.

Data from Trendalytics, meanwhile, indicates engagement of Shark Beauty’s Instagram has grown 224 percent over the past year, where Dyson’s has decreased by 17 percent during the period. With that being said, one of Dyson’s biggest strengths on social is user-generated content, and engagement with posts mentioning the brand have grown 636 percent over the past year, where engagement with those mentioning Shark Beauty has dropped by 29 percent despite the growth of its owned channels.

While the company’s focus has been on hair tools thus far, Shark Beauty, now on the brink of its third anniversary, is eyeing potential expansions beyond its core category.

“So far the world has seen a lot of hair care products from us, but we were strategic in not naming ourselves Shark Hair,” said Lessing. “Over the next 12 months, we’re going to be exciting customers with what else they could expect from the Shark Beauty brand.”