Renault Group worldwide sales amounted to 549,099 vehicles in the first quarter, up 2.6% versus 2023 Q1. In Europe[2], Group sales were up 4.3%

“Q1 revenue continues to illustrate the strict application of our commercial policy focused on value. The strong orderbook at the end of March and our upcoming launches will provide sequential acceleration in the activity. Coupled with an increase in cost reduction, they will drive our financial performance.

Renault Group has already opened a new chapter with sound fundamentals: performance improvement and efficient capital allocation on the one hand and flexibility on the other. Our launches, both with electric and ICE & hybrid vehicles, demonstrate our flexibility to adapt to the ups and downs of the energy transition.

Day after day, our organization is gaining in agility and speed of execution which are clear strengths in the current environment.” said Thierry Piéton, Chief Financial Officer of Renault Group.

Commercial results: First quarter highlights

Renault Group recorded 549,099 sales in 2024 Q1, up 2.6% versus 2023 Q1. In Europe, the Group maintained its third position with 391,490 units sold, up 4.3%.

In a transitional first quarter ahead of the commercial launches of 10 models between now and the end of 2024, Renault Group grew its sales thanks to the dynamism of its three automotive brands.

Renault brand worldwide continued its progression with 365,356 sales in 2024 Q1, up 3.1% versus 2023 Q1. The brand remained on the podium in Europe where it pursued its commercial policy focused on value:

- More than one out of two sales were in the retail channel[5].

- C-segment and above represented 37% of sales with a range of 4 vehicles: Arkana, Megane E‑TECH electric, Austral and Espace E-TECH Hybrid. On these models, high trim versions represented a large majority of sales.

- Electrified passenger car sales continued to increase to reach 48% mix of sales, up 8 points versus 2023 Q1. This is driven by the success of E-TECH Hybrid engines, with record low consumption level. Electric passenger cars represented 10.5% mix of sales and their sales will continue to grow with the upcoming launches of Scenic E-TECH electric, Renault 5 E-TECH electric and Renault 4 E-TECH electric.

- The brand also reinforced its LCV’s[6] leadership in Europe[7] with 76,354 units sold, up 12.9% versus 2023 Q1, in a market up 12.0%.

2024 promises to be a historical year for the Renault brand, with 7 new launches:

- 2 new all-electric vehicles with Scenic E-TECH electric and Renault 5 E-TECH electric.

- 2 new hybrid vehicles in Europe: Rafale E-TECH and Symbioz.

- New Renault Master (ICE and all-electric versions).

- 2 new vehicles in markets outside Europe: Kardian and a Renault Korea Motors vehicle (D-SUV).

In addition, Renault brand will benefit from the facelift of Captur and the launch of Renault Duster for international markets.

Dacia recorded sales up 3.6% in Europe, with 153,439 units. Especially, Sandero became the most selling car, all sales channels combined in Europe in the first quarter, with 72,995 units sold (+20.2% versus 2023 Q1).

The rest of the year will be marked by the launch of the new generation of its two other strong pillars, recently revealed:

- All-New Dacia Duster which has recorded more than 18,000 orders during its first 30 days on the market, and even before its arrival in the dealership network early summer.

- New Dacia Spring, one of the most affordable electric cars in the European market.

Alpine recorded 1,065 registrations (+88.8% versus 2023 Q1), thanks in particular to the success of the top‑of-the-range versions of the A110, its sporty two-seater coupé.

On June 13 2024, Alpine will present the A290 at the 24 Hours of Le Mans® (France). Alpine’s future sporty electric 5-seater hot hatch will be the brand’s first 100% electric model.

First quarter revenue

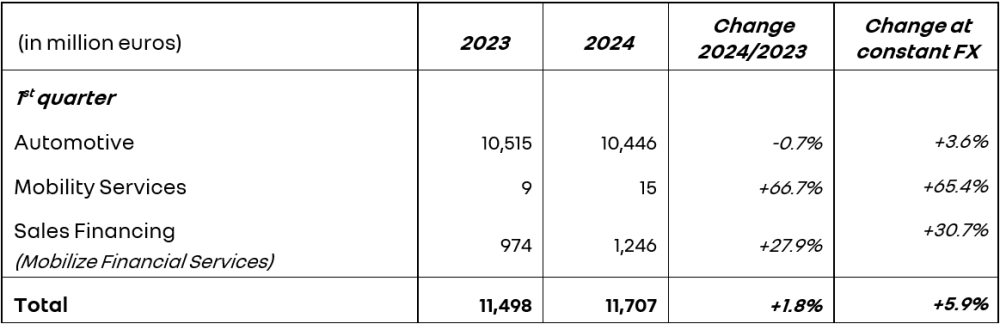

Group revenue for 2024 Q1 amounted to €11,707 million, up 1.8% compared to 2023 Q1. At constant exchange rates[8], Group revenue was up 5.9%.

Automotive revenue reached €10,446 million, down 0.7% compared to 2023 Q1. It included -4.3 points of negative exchange rates effect (-€447 million) mainly related to the devaluation of the Argentinean peso and to a lesser extent to the Turkish lira. At constant exchange rates[8], it increased by 3.6%. This evolution was mainly explained by the following:

- A robust price effect of +4.1 points, reflecting the continuation of the commercial policy focused on value and price increases to offset currency devaluations.

- A stable product mix effect of +0.1 points explained by the positive impact of Renault brand’s C-segment & above vehicles offset by i) the negative effect from the end of life of Zoe and ii) the continuing success of Clio, Twingo (despite its end of life) and Sandero which had a negative impact as their average selling prices are below the Group’s one.

- A stable geographic mix of +0.6 points, thanks to the sales performance in Europe.

- A negative volume effect of -4.6 points. The 2.6% increase in registrations was offset by a higher destocking of the independent dealer network over the quarter compared to 2023 Q1 (-40k units year-on-year).

- A positive sales to partners effect of +2.4 points, thanks to increased R&D billings in line with the ramp-up of Group’s partnerships.

- A positive ”Other” effect of +1.0 point, primarily related to the solid performance in parts and accessories.

Mobility Services contributed €15 million to 2024 Q1 Group revenue compared to €9 million in 2023 Q1.

Mobilize Financial Services (formerly RCI Bank and Services) posted revenue of €1,246 million in

2024 Q1, up 27.9% compared to 2023 Q1, due to higher interest rates and to the increase of average performing assets (at €54.2 billion) which increased by 9.8% compared to 2023 Q1.

At March 31, 2024, total inventories (including the independent network) represented 530,000 vehicles:

- Group inventories at 228,000 vehicles.

- Independent dealer inventories at 302,000 units.

It strongly decreased compared to 2023 Q1, which stood at 580,000 units.

The level of total inventories at the end of March was back in line with the normal seasonal evolution and supported by a sound orderbook at 2.5 months of forward sales at the end of March.

2024 FY financial outlook

Renault Group confirms its 2024 FY financial outlook with:

- a Group operating margin superior or equal to 7.5%

- a free cash flow superior or equal to €2.5 billion

Upcoming product offensive and acceleration of cost reduction will remain the drivers of operational performance and strong cash generation in 2024:

- 2024, an historic year with 10 new vehicles launches (7 new vehicles under Renault brand[9], 2 vehicles under Dacia brand and 1 vehicle under Alpine brand).

- Faster cost reductions and time-to-market for both thermal and electric vehicles, already engaged with a continuous trajectory.

Renault Group’s consolidated revenue

Renault Group’s top 15 markets at the end of March 2024

Total Renault Group PC + LCV sales by brand

[1] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

[2] ACEA European Scope.

[3] Renault Group, passenger cars, France, Germany, Italy, Spain, and the United Kingdom.

[4] Renault brand, passenger cars, Europe.

[5] Renault Group, passenger cars, France, Germany, Italy, Spain, and the United Kingdom.

[6] Excluding pick-up.

[7] ACEA European Scope.

[8] In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period.

[9] 7 new vehicles launches for Renault Brand in 2024 without Renault Duster (outside Europe) and Captur facelift.

SOURCE: Renault Group