UK car production fell by -8.4% in August, according to new figures published today by the Society of Motor Manufacturers and Traders (SMMT)

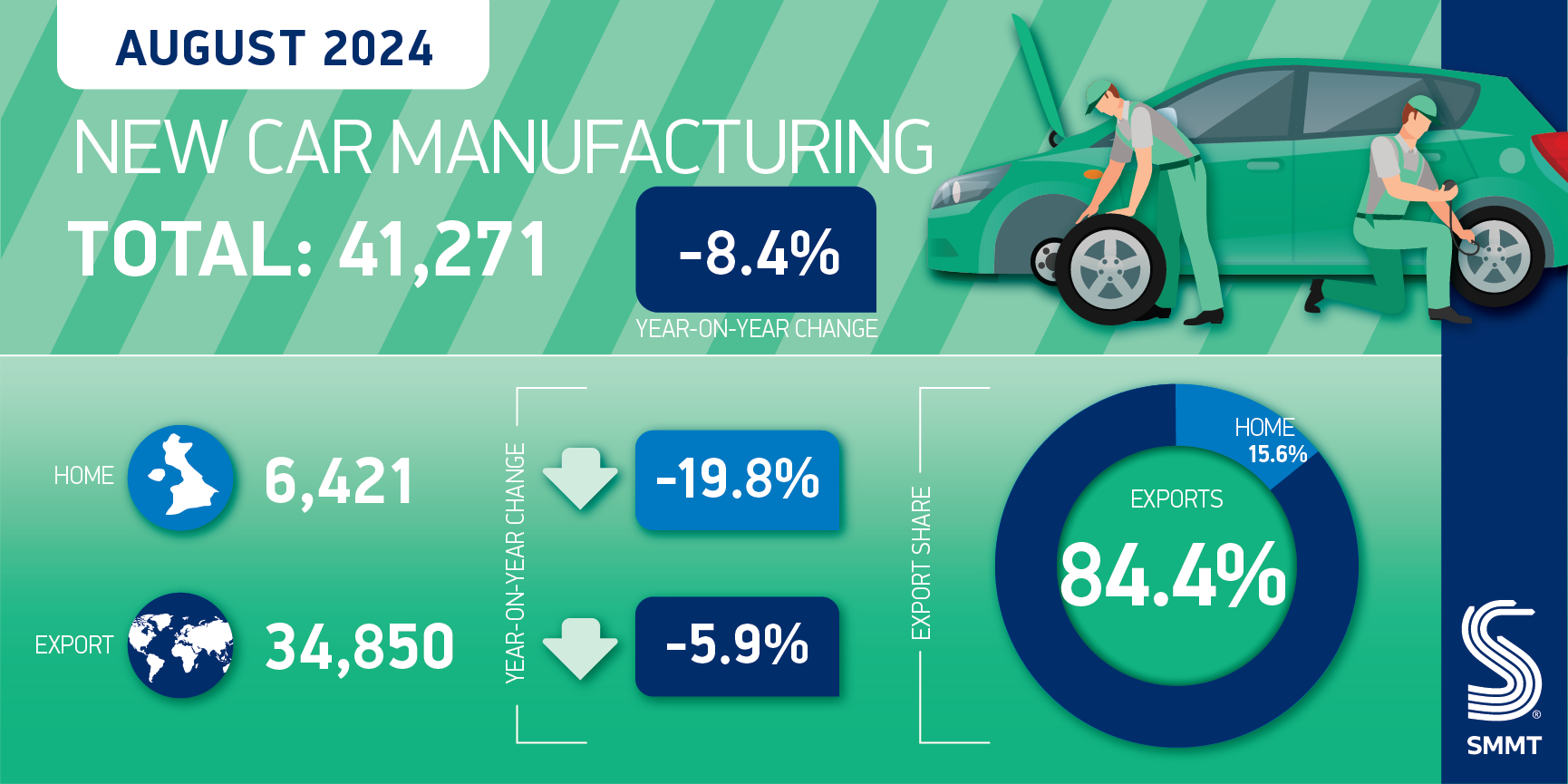

UK car production fell by -8.4% in August, according to new figures published today by the Society of Motor Manufacturers and Traders (SMMT). With August conventionally a low output month due to summer shutdowns, the decline was equivalent to just 3,781 fewer units as 41,271 new cars rolled off production lines.

The decline continues the trend seen across the year, as factories wind down production of key models and retool for new – primarily electric – model production, following the £24 billion of UK automotive manufacturing investment announced last year.

Electrified (battery electric, plug-in hybrid and hybrid) production for the month fell by -25.9%, leading to a fall in share of output to 29.6%. However, this decline is expected to be reversed in the longer-term as new models come onstream.

Production for the domestic market appeared to decline sharply, by -19.8%, although this impact is amplified by the small overall output volume for the month and the fact that the vast majority of UK production is for export.

By comparison, exports fell by a modest -5.9%, largely due to changeovers of models built for EU markets. The 27 Member States remain by far the biggest export destination, comprising 49.8% of total exports. The US (17.0%), China (6.5%), Japan (5.1%) and Australia (4.4%) made up the remaining top five export destinations for UK car production, with growth in both the American and Japanese markets.

Year to date, UK car production is down -8.5% at 522,823 units and output for the UK market is up 12.3% despite August’s domestic decline.

Mike Hawes, SMMT Chief Executive, said,

With the traditional summer shutdowns and factories prepping to switch to new models, August was always going to be a quieter month for output. The sector remains optimistic about a return to growth, however, with record levels of investment announced last year.

Realising those investments and securing more depends on the UK industry maintaining its competitiveness so we look forward both to the Chancellor’s Autumn budget and the government’s proposed Industrial Strategy as critical opportunities to demonstrate that it backs auto. Labour’s Automotive Sector Plan, launched at their Party Conference a year ago, should be the blueprint with its proposals for cheaper, green energy, skills investment and the cultivation of healthy markets here and abroad. These are the measures that would enable the industry to drive economic growth in every part of the country.

SOURCE: SMMT